The purpose of this article is to discuss and understand the difference between a W-2 employee and a 1099 independent contractor. How do you determine if the individual is an employee?

To answer this question, first let’s look at the Common Law test, then we will review the factors used by the IRS in determining employee status and what to do if you think you have misclassified workers.

Common Law Test

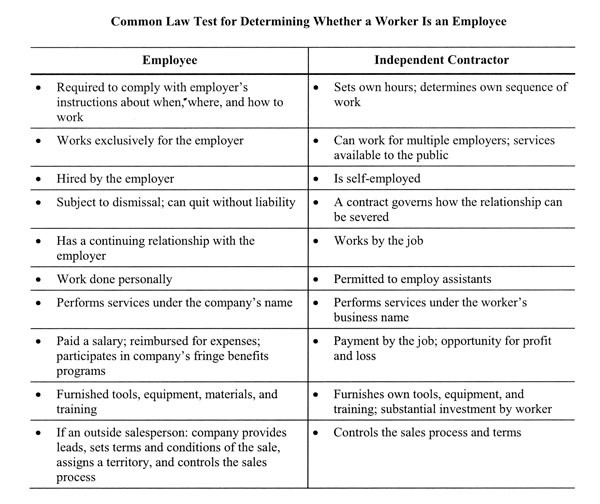

The basis of the common law test is straightforward: Does the employer have the right to control what work will be done and how that work will be done? If the answer is yes, then the worker is an employee subject to payroll tax withholding. If the employer has the right to control the result and not the method in which the result is achieved, then the worker generally qualifies as an independent contractor.

The table below is used for determining whether a worker is an employee under the Common Law test:

Factors Used By IRS

Factors Used By IRS

IRS auditors look at the following four categories to make a classification determination: Behavioral Control, Financial Control, the Relationship of the Parties and the statutory nonemployee designation.

Behavioral Control – Does the employer have the right to direct or control how the worker performs the specific task? More specifically, ask yourself the questions below and if you answer yes then the worker is most likely an employee.

- Are instructions given about when, where, or how to work?

- Are directions provided as to which tools or equipment to use?

- Are worker’s told whom to hire or assist with work?

- Is management approval required before taking certain actions?

- Do workers undergo periodic or ongoing training?

Financial Control – The most significant evidence of financial control is whether or not the worker has an opportunity to either make a profit or suffer a loss. If so, the worker is most likely an independent contractor. The following four aspects can be used to determine financial control.

Investment – for a worker to be treated as an independent contractor, the worker must have an investment in facilities and tools used in the course of performing services.

Expenses – independent contractors will normally incur expenses at their own cost that impact the worker’s opportunity for profit. The focus here is on unreimbursed expenses, specifically fixed or ongoing costs that are incurred regardless of whether or not work is performed. Examples are:

- Rent

- Utilities

- Training

- Advertising

- Insurance

- Wages to others

- Licenses

Marketable Services – independent contractors will offer their services to the available market and will normally maintain a visible location and advertise their business. Lack of these activities may point to the worker be classified as an employee.

Method of Payment – in general independent contractors are paid a flat fee or commission for a performing a task. Employees however are generally paid by the hour, day, or pay period indicating a guaranteed return for their work.

Relationship Of The Parties – How do the worker and business view each other in terms of control.

Written Contracts – a written agreement describing the worker as an independent contractor and indentifying the payment terms, reimbursable expenses, and work performance methods may be used to classify the worker as an independent contractor, but in itself is not sufficient evidence.

Employee Benefits – benefits such as sick or vacation time and health insurance are normally only provided to employees and would weigh heavily in determining that a worker is an employee.

Termination – the ability to immediately terminate the worker would indicate employee status. However this should not be confused with a business’ ability to refuse payment to an independent contractor for unsatisfactory work.

Continuing Relationship – independent contractors are usually hired for a specific period of time or task to be performed. Employees are usually hired for an indefinite period.

Regular Business Activity – if a worker’s services are a primary aspect of the regular business activity of the organization, then the worker is most likely subject to a certain amount of control by the business and is, therefore, considered an employee.

Statutory Nonemployees

Licensed real estate agents are statutory nonemployees and are treated as self-employed for all Federal tax purposes, including income and employment taxes, if:

- Substantially all payments for their services as real estate agents are directly related to sales or other output, rather than to the number of hours worked

- Their services are performed under a written contract providing that they will not be treated as employees for Federal tax purposes

This category includes individuals engaged in appraisal activities for real estate sales if they earn income based on sales or other output.

Worker misclassified?

If you feel you may have workers misclassified, the best course of action would be to reclassify the workers, back to the beginning of the current year.

In the event the IRS reclassifies an individual to an employee, the employer will most likely be required to pay employment tax that was not withheld on payments during the misclassification. IRS code allows for employment tax payments of 1.5% of the employee’s federal income tax liability and 20% of the amount that should have been withheld for the employee’s FICA taxes. In addition, if the employer failed to file 1099s during the period of misclassification, the employer’s liability doubles to 3% and 40% respectively. Employers that are required to pay this liability may not recover any tax from the employee or deduct these amounts from future compensation.

Any intentional disregard to withhold taxes will most likely result in more stringent penalties.

If you have any questions contact your accountant or reach out to me.