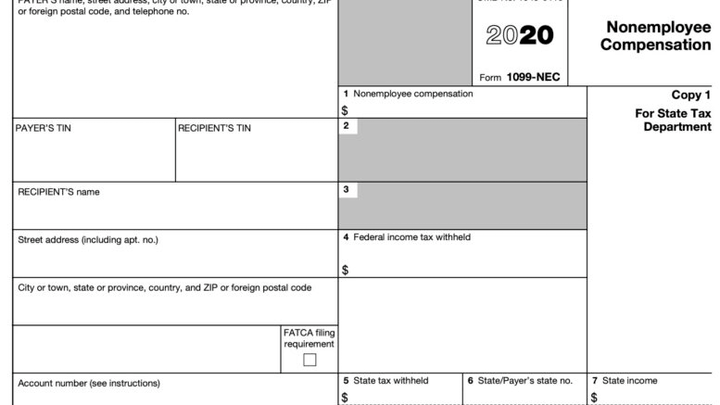

(Non-employee Compensation)

The 1099-NEC is used strictly for reporting independent contractor payments of $600 or more in the course of your trade or business. You will still be required to use the 1099-MISC for such items as royalties, rent, and healthcare payments.

If you’re accustomed to filing Form 1099-MISC to report nonemployee compensation, the IRS has made things more difficult as usual. The government is now bringing back Form 1099-NEC for that purpose, a form that was last used in 1982.

The 1099-NEC is being reintroduced to address confusion created by the PATH (Protecting Americans from Tax Hikes) Act of 2015. That Act established different due dates for the various types of income reported on the 1099-MISC, leading to undeserved penalty notices for filers. The renewed 1099-NEC form separates out nonemployee compensation from other sections of the 1099-MISC and imposes a filing deadline of Feb. 1, 2021.

To be clear, you may still need to use both forms. The 1099-NEC is used strictly for reporting independent contractor payments of $600 or more in the course of your trade or business. You will still be required to use the 1099-MISC for such items as royalties, rent, and healthcare payments. You’ll also find that the boxes have been rearranged on the 1099-MISC; Box 7, where nonemployee compensation was once reported, now hosts the check box for direct sales of $5,000 or more. The deadline for filing the 2020 tax year’s 1099-MISC is March 31, 2021 if filing electronically

WHO SHOULD FILE A 1099-NEC?

Any business that pays people for services who are not employees will be affected by this change. The form will cover payments to consultants like attorneys, architects, and accountants, for instance, as well as nonemployee sales commissions. It will have particular relevance for those employing so-called gig economy workers.

HOW TO PREPARE

With the year-end filing season fast approaching, it’s not too early for businesses to acquaint themselves with the coming change and to update their software and filing systems in anticipation of the new form. A sample form is available now on the IRS website – it may be worth downloading and reviewing it in advance. Also, most states that support Form 1099-MISC have indicated that they also plan to require Form 1099-NEC to be filed to their state.

The IRS offers detailed instructions and information about both forms on its website WWW.IRS.GOV