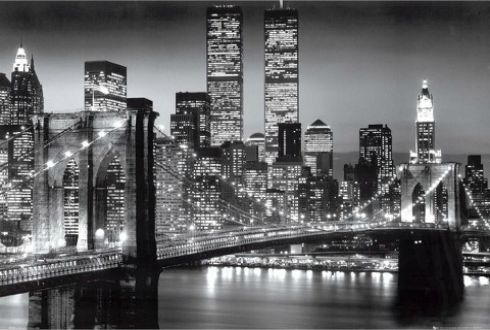

People throughout the U.S. are flocking into cities that have the right balance of live/work/play environments. When you look at the U.S. cities that had the best return on capital investments over the past several years, they are the ones that have invested heavily into turning from a 9-5 town into an 18 hour city. It has been demonstrated that the right urban mix of live/work/play draws density, which raises property values which in turn attracts more investment capital. To take advantage of these opportunities requires a deep working knowledge of the local U.S. markets.

At this point, I will turn your attention to Demographics and what the U.S. real estate market may look like in seven years.

The Baby boomer generation (1946-1964) is reaching retirement age. However, they are staying in the workforce longer, trying to recoup the losses endured during the great recession. When they do retire, the trend is no longer to look at “golf course” communities but rather, we see that they prefer to stay in urban centers that provide access to excellent medical care.

Millennials (1980-2000) tend to favor renting apartments currently. They are called “renters by choice” as many can afford home purchases but are still spooked by the market collapse of 2005. However, in seven years’ time, look for many of them to start migrating out of urban cities and flocking to suburban areas to purchase homes to raise their families.

Between these two groups, you are looking at over 160 million people, so the potential for profit is strong if you are an investor, real estate agent or property manager, but you must start positioning yourself correctly now to take advantage of these opportunities in the future.

Image via